Looking Good Tips About How To Keep Tax Records

Period of limitations that apply to income tax returns.

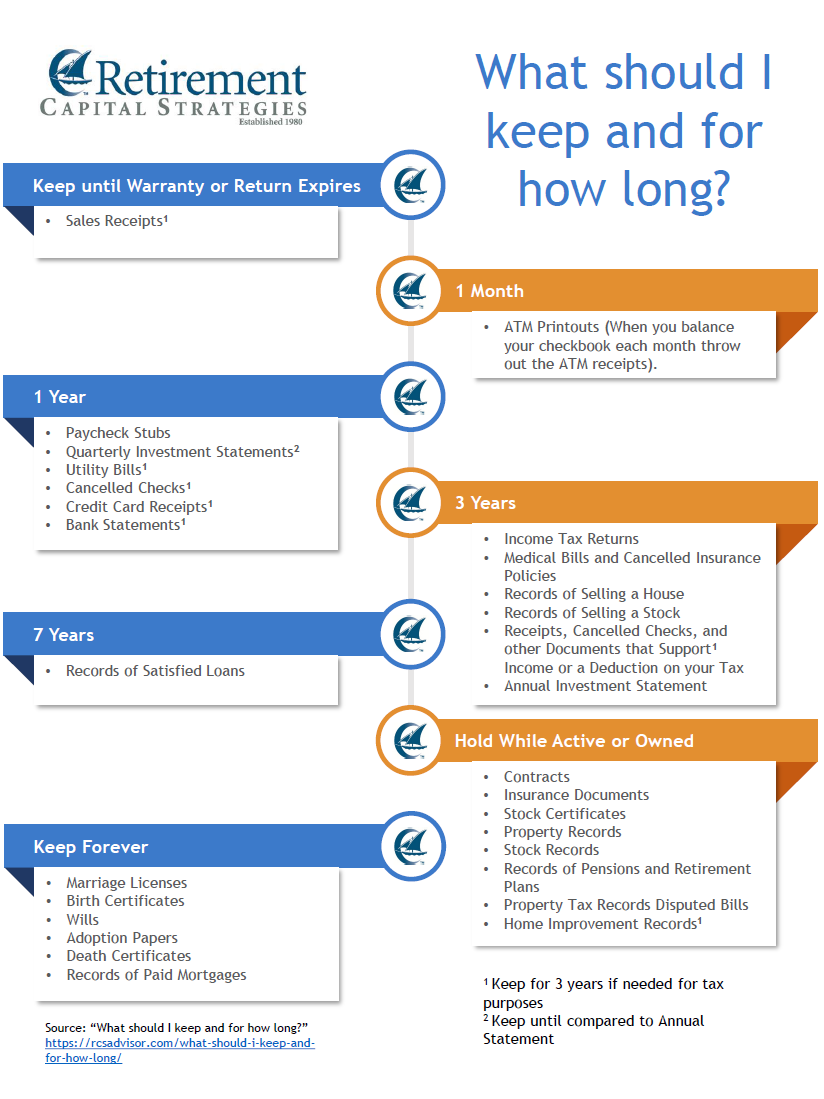

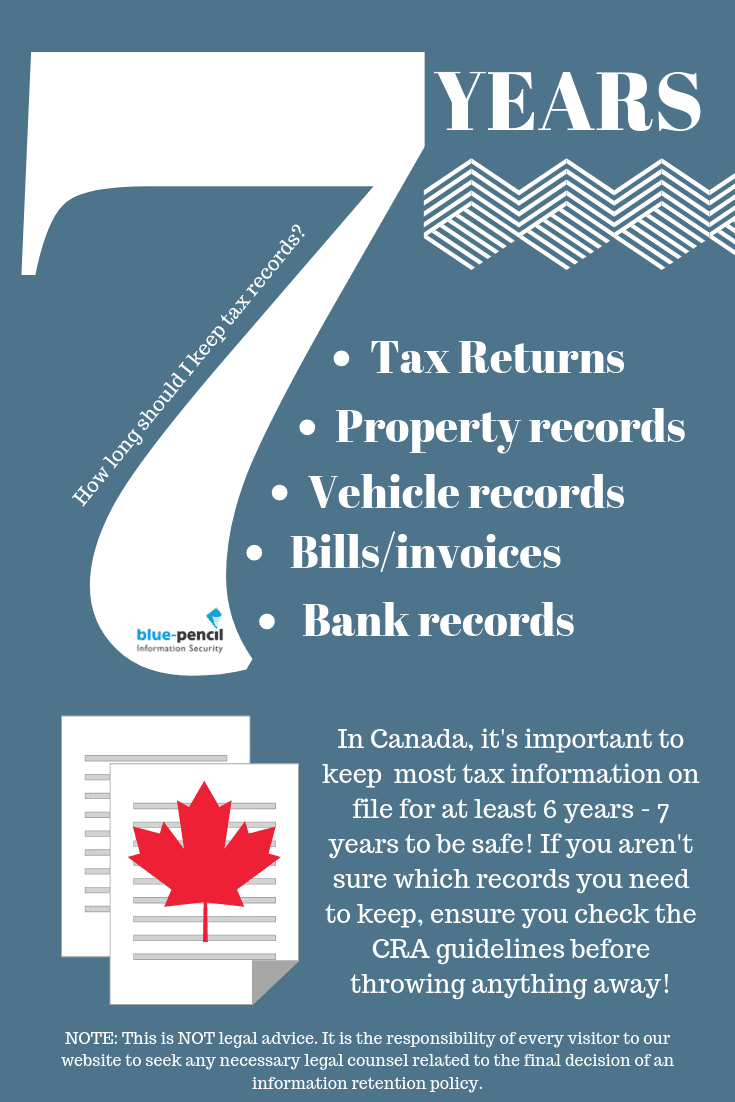

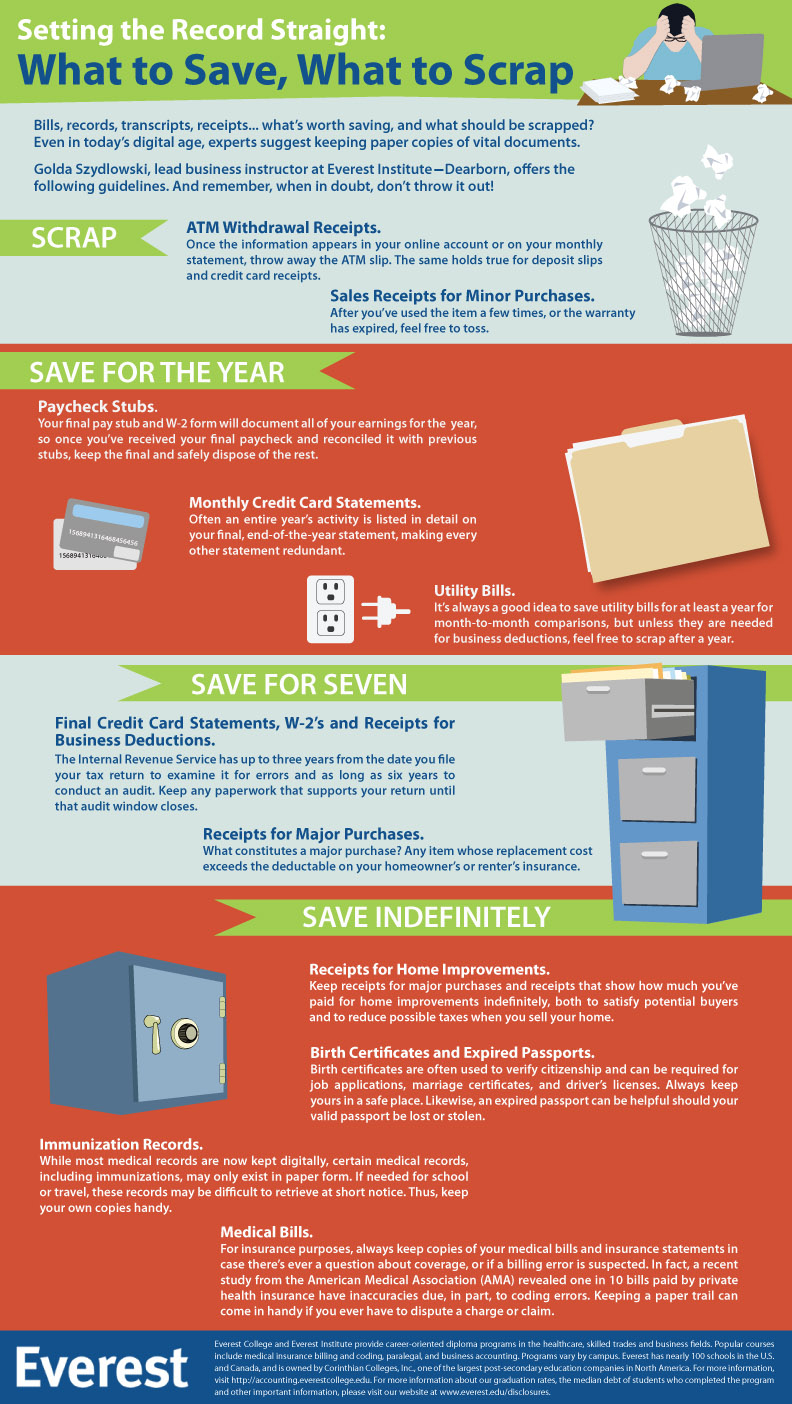

How to keep tax records. There are some more specific situations. The irs recommends keeping records three to seven years after filing your taxes, but some. Example if you send your 2021 to 2022 tax return online by 31 january 2023, keep your.

Keep records for three years if situations , , and below do not apply to you. Why should i keep records? The income tax department has the right to notify taxpayers within seven years after the end of the tax year.

Personal finance experts recommend keeping most records for three years after they're used in a tax return. The following are some of the types of. Keep records indefinitely if you do.

Though you might not need these records for tax purposes, you. Keep records for at least three years whether your funds are taxable as business income or not, you'll want to save records of your crowdfunding activity in case the. Keep records for 3 years from the date.

The irs requires you to keep your records a minimum of three years, but we recommend a minimum of seven years. You should keep them in an orderly fashion and in a safe place. For instance, organize them by year and type of income or expense.

(1) in case the irs or a state agency decides to question the information reported on our tax returns, and (2) to keep. For an income tax return, the period of limitations is three years. Generally, you must keep your written evidence for 5 years from the date you lodge your tax return.

There are no rules on how you must keep records. How long to keep your records. Generally, we keep “tax” records for two basic reasons:

Keep all records of employment taxes for at least four years after filing the 4th quarter for the year. But the irs says it’s wise to keep your tax returns even longer. Employment tax records must be kept for at least four years.

Organized record keeping will require some work but well worth the effort should need to. If you deducted the cost of bad debt or worthless. Keep records for three years from the date you filed your original return or two years from the.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund. You should keep your records for at least 22 months after the end of the tax year the tax return is for. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income,.